Modern Portfolio Theory... and Practice

January 15, 2022 15 min read

Throughout the 2020-21 pandemics the M2 money supply of the majority of European currencies exploded by 20-25%, of US dollar - by whopping 40%! Interest rates on investment-grade bonds are negligible compared to that, and they no longer serve their purpose as the primary conservative investment (3% interest is not any good, if the body of the bond looses 10-20% of its value a year because of the excessive money creation). Thus, a conservative investor has to go for a diversified portfolio of stocks, which can be constructed in the framework of the Modern Portfolio Theory - a trivial application of linear algebra and numeric optimization (oh, I meant, artificial intelligence, what am I saying). And as they say in Russia, the difference between theory and practice is that in theory there is no difference, while in practice there is some.

Theory

Motivation

Say, you want to invest your money. Bank deposits or bonds offer you a predictable way to do this: you freeze your money for a while and get a fixed interest rate, so that your money grow exponentially over time.

The problem is: interest rates that bonds and deposits offer are so low, that they no longer cover even CPI/inflation growth, not speaking of the money creation rate, which is much faster.

So, as a conservative investor, you have to opt out of bonds/deposits and buy actual property. People would often invest into real estate (which has low liquidity, requires you to have a large sum of money and is generally a big hassle), some people opt into gold, or into controversial cryptocurrencies.

Today I am going to discuss a reasonably conservative financial investment - stocks portfolio.

Problem with stocks is that although they offer much higher interest rates than bonds/deposits on average and don’t lose their value due to money creation as bonds and deposits do, they are volatile.

For instance, if you have a time point in near future, when you have to pay a certain sum (e.g. college fees for your child in 10 years), you would be very unhappy, if your stocks all of a sudden go down by 200% (which is totally possible due to an unexpected recession).

So, opting for stocks rather than bonds, you trade away predictability of yield for higher average yield. This is called “Risk-return tradeoff”.

However, you can minimize the risks you assume by buying stocks, if you sufficiently diversify your money across a large enough selection of stocks. Diversification allows one to keep a high average yield, while making variance lower.

The mathematical theory behind this approach is called Modern Portfolio Theory (MPT). It is not so modern actually, as it was created circa 1952. Here I will formalize the problem of optimizing your portfolio to keep the reward high and risk low in terms of MPT.

Problem formalization

To describe the risk, associated with investing in a certain equity, we are going to use variance or standard deviation of that equity. Imagine that equity was a perfectly predictable bank deposit or a bond, that just grows exponentially at an average yield rate in a totally predictable way. Now, in real life your stock prices would always diverge form that desirable exponential curve. Given historical data, we can mathematically describe those deviations for average yield curve as a variance or standard deviation.

High variance means high risk, which is undesirable - just imagine that in 10 years you need your money to pay for your child’s college, while market shows a deep slump.

So what you are aiming for is to get a high expected yield on your assets, while keeping the variance of your portfolio low.

I have to make a little reservation here, however. In real life your wouldn’t mind against high variance of your investment, if it only grows like a rocket at an unsteady rate - you would actually mind against the risk of downside. The theory that re-formulates the risk in terms of probability of downside is called Post-Modern Portfolio Theory, but I am not going to discuss it here.

Ok, suppose that you have 500 S&P500 stocks and you want to create a portfolio, which is a linear combination of those stocks with some weights …. Return of each stock is modeled as .

You want to minimize the variance of your portfolio: .

Variance of a linear combination of non-independent random variables is a quadratic form, with its matrix being the covariance matrix.

E.g. .

To re-write this in matrix form:

.

Or, in symbolic notation , where is covariance matrix (where element is the covariance between random variables and ).

So, we want to solve the following problem: we set the expected income of the portfolio (e.g. 15% growth) and portfolio size (e.g. $100,000) and try to pick such instruments for our portfolio, that :

(1) ,

(2) ,

(3) .

Here equation (1) represents the portfolio variance, we want to minimize, constraint (2) represents the expected portfolio yield ( being the projected mean yield of the -th stock) and constraint (3) represents the total portfolio price (with representing the price of -th stock).

Additionally, I want to introduce one more constraint. I want our portfolio to be sparse - i.e. I don’t want to have all the 500 S&P 500 companies in it, but just a few. Say, 15-30 will do. Otherwise, it is going to be inconvenient to quickly sell it before recession, especially if the broker imposes a flat fee per deal.

In order to achieve sparsity, we can use L1 regularization approach:

(4)

We set an arbitrary limit on the sum of our sum’s weights. As a result, only a small subset of weights will end up non-zero.

Additionally, if we are not planning to short any stocks (which makes sense for a conservative investor), we will require all our weights to be non-negative (and ideally integer as well, but this is numerically inconvenient).

This problem is well-known and mathematically tractable. It is called Quadratic Programming.

Practice

I implemented the solution in python/pandas/numpy and cvxopt quadratic programming library.

S&P 500 dataset

As the dataset I used S&P 500 2013-2018 daily prices dataset from Kaggle.

Covariance matrix

Calculation of the covariance matrix is somewhat non-trivial.

How to calculate means, required to calculate covariance?

First, recall that sample covariance is .

What shall we use as mean ? Pandas Dataframes come with a function , which uses global average of time series as mean.

However, I believe that ideally we shall use a power function as a mean, where is starting cost of our stock in 2013, is its average interest rate from 2013 to 2018, e.g. 1.2 and is time in months or years.

Alternatively, they often use slipping average of shares prices + dividends as mean.

Should be semi-definite, in practice is not.

One more issue with the covariance matrix is that our time series of stock prices often contains NaNs. E.g. a merger happened, and a company ceased to exist, or other company appeared. Stock prices after/before that event become NaNs.

The problem with NaNs is that covariance matrix stops being positive semi-definite, which breaks the quadratic programming.

So, we have two solutions here: either remove rows with NaNs, which makes S&P500 more of an S&P470. Or apply L2 regularization by adding unit matrix with some coefficient and effectively increasing all the eigenvalues by some value until they all become positive, so that the covariance matrix becomes positive semi-definite.

Risk-return trade-off curve

Ok, here’s the code. First, load our data.

all_stocks = pd.read_csv("./data/kaggle_sandp500/all_stocks_5yr.csv")

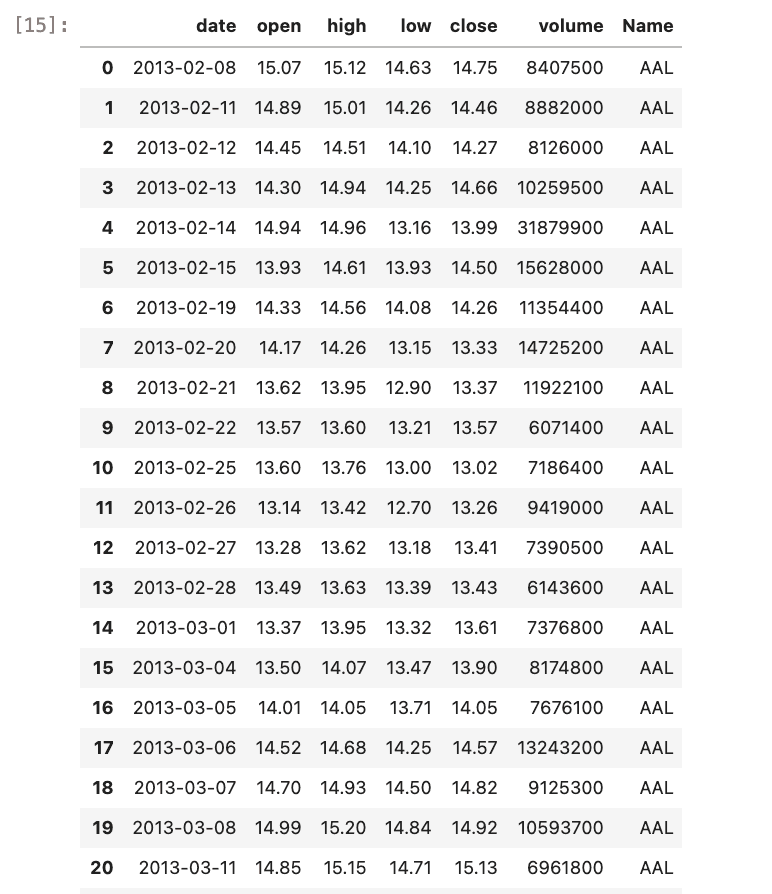

all_stocks.head(50)Now, pivot the dataset, so that it could be used to construct the covariance matrix, and remove NaNs:

all_stocks_pivoted = all_stocks.pivot(index='Name', columns='date', values='close')

all_stocks_pivoted = all_stocks_pivoted.dropna()

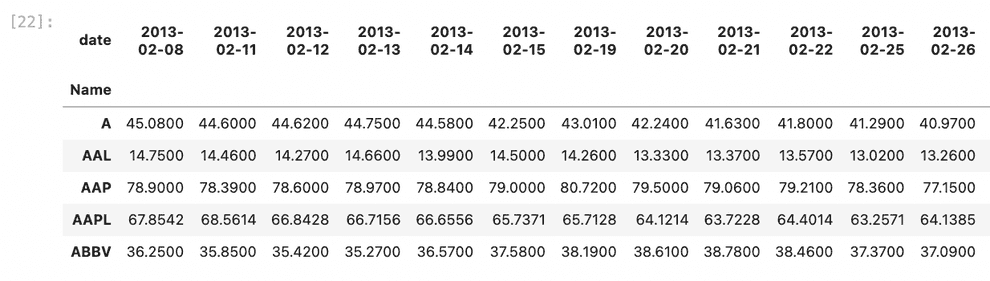

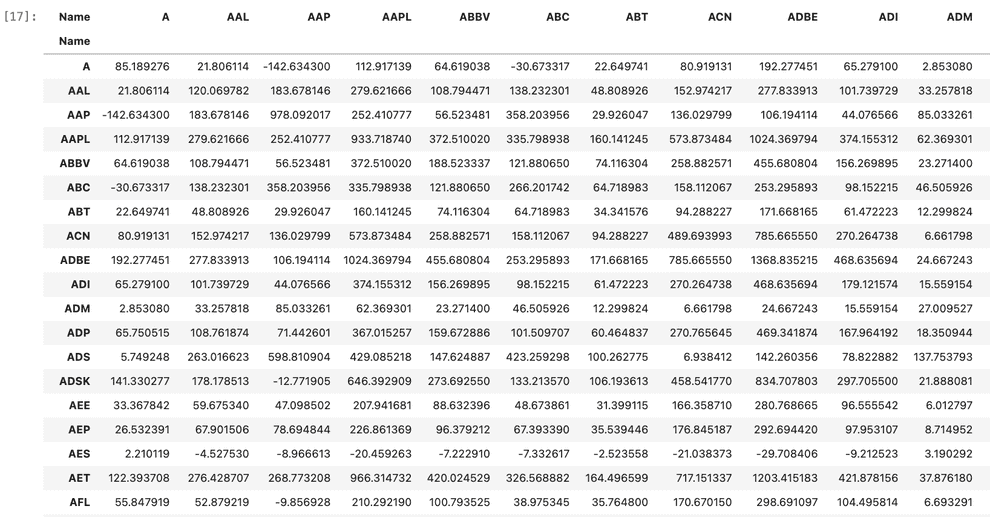

all_stocks_pivoted.head(5)After that we can calculate our covariance matrix:

covariance_matrix = all_stocks_pivoted.transpose().cov()

covariance_matrixUsing the covariance matrix, we can run quadratic programming to optimize our portfolio.

I assume that initially we have $100,000, want to have $115,000 in a year and have our portfolio contents somewhat sparse with L1 norm constraint set to 1000, which results in a few dozen stocks. Here for simplicity I assume that expected returns of the shares are means of their observed returns in 2013-2018.

from cvxopt import matrix, solvers

def solve_optimization(total_cost_constraint, return_constraint, norm_constraint):

covariance_matrix_np = covariance_matrix.to_numpy()

dimension = covariance_matrix_np.shape[0]

P = matrix(covariance_matrix_np)

q = matrix(np.zeros(dimension, dtype=float))

# construct inequality constraints

G = np.zeros(covariance_matrix_np.shape, dtype=float)

for i in range(dimension):

G[i][i] = -1

G = matrix(G)

h = np.zeros(dimension, dtype=float)

h = matrix(h)

# construct 3 equality constraints: on total cost, on return and on L1-norm

# total_cost_constraint specifies the total monetery value of our portfolio

total_cost_equation_coefficients = all_stocks_pivoted["2018-02-07"].to_numpy()

# return_constraint sets a fixed level of return, we expect from our portfolio

return_constraint_equation_coefficients = all_stocks_pivoted["2018-02-07"].divide(all_stocks_pivoted["2013-02-08"]).pow(0.2).mul(all_stocks_pivoted["2018-02-07"]).to_numpy()

# norm_constraint sets L1-norm on weights of instruments in our portfolio, serving as a computationally efficient proxy for L0-norm;

# we want to get a sparse solution - not all 500 S&P companies with some weights, but only a small subset, e.g. 20;

# by relaxing the norm_constraint, we can add more companies to our portfolio, by making it smaller - remove some

norm_constraint_equation_coefficients = np.ones(dimension, dtype=float)

A = np.vstack((total_cost_equation_coefficients, return_constraint_equation_coefficients, norm_constraint_equation_coefficients))

A = matrix(A)

b = np.array((total_cost_constraint, return_constraint, norm_constraint), dtype=float)

b = matrix(b)

# solve QP

return solvers.qp(P, q, G, h, A, b)

solution = solve_optimization(total_cost_constraint=100000, return_constraint=115000, norm_constraint=1000)Now that optimization is finished, let’s take a look at our portfolio: its variance and constituents.

from cvxopt.blas import dot

import math

print(f"Standard deviation is ${math.sqrt(dot(solution['x'], matrix(covariance_matrix.to_numpy()) * solution['x']))}\n")

def get_tickers_and_weights(solution, prices):

non_zero_weights = {}

for index, weight in enumerate(solution):

if weight > 0.1:

non_zero_weights[index] = weight

for index, weight in non_zero_weights.items():

print(f"Buy {prices.index[index]:>5}, with weight {weight:>7.2f}, stock price {all_stocks_pivoted['2018-02-07'].iloc[index]:>7.2f}, total cost {all_stocks_pivoted['2018-02-07'].iloc[index] * weight:>9.2f}")

get_tickers_and_weights(solution['x'], all_stocks_pivoted)Result is:

Standard deviation is $2008.011151528987

Buy AMZN, with weight 6.42, stock price 1416.78, total cost 9101.09

Buy DISCA, with weight 44.45, stock price 23.12, total cost 1027.76

Buy EA, with weight 51.19, stock price 123.05, total cost 6298.40

Buy ED, with weight 7.70, stock price 75.26, total cost 579.37

Buy EXPE, with weight 0.79, stock price 129.33, total cost 102.80

Buy HCP, with weight 103.94, stock price 23.38, total cost 2430.05

Buy IBM, with weight 96.75, stock price 153.85, total cost 14885.51

Buy LB, with weight 35.77, stock price 49.11, total cost 1756.75

Buy MAT, with weight 185.08, stock price 17.00, total cost 3146.35

Buy NFLX, with weight 19.35, stock price 264.56, total cost 5119.91

Buy NVDA, with weight 33.91, stock price 228.80, total cost 7759.56

Buy PCG, with weight 3.24, stock price 39.48, total cost 127.78

Buy PRGO, with weight 25.20, stock price 87.52, total cost 2205.65

Buy PSA, with weight 93.25, stock price 185.35, total cost 17284.49

Buy RE, with weight 46.88, stock price 246.70, total cost 11566.49

Buy RL, with weight 86.28, stock price 107.70, total cost 9292.00

Buy RRC, with weight 43.45, stock price 13.12, total cost 570.00

Buy SCG, with weight 47.76, stock price 36.66, total cost 1750.94

Buy SRCL, with weight 68.58, stock price 72.84, total cost 4995.05As you can see, our solution likes IT giants that performed especially well in the given timeframe, such as Amazon, Netflix and Nvidia, as well as mediocre IBM. Also, many companies from other sectors of industry were included, which minimized the variance. However, this result is not very robust, as those companies performed well in 2013-2018, but in other periods of their existence didn’t do as well.

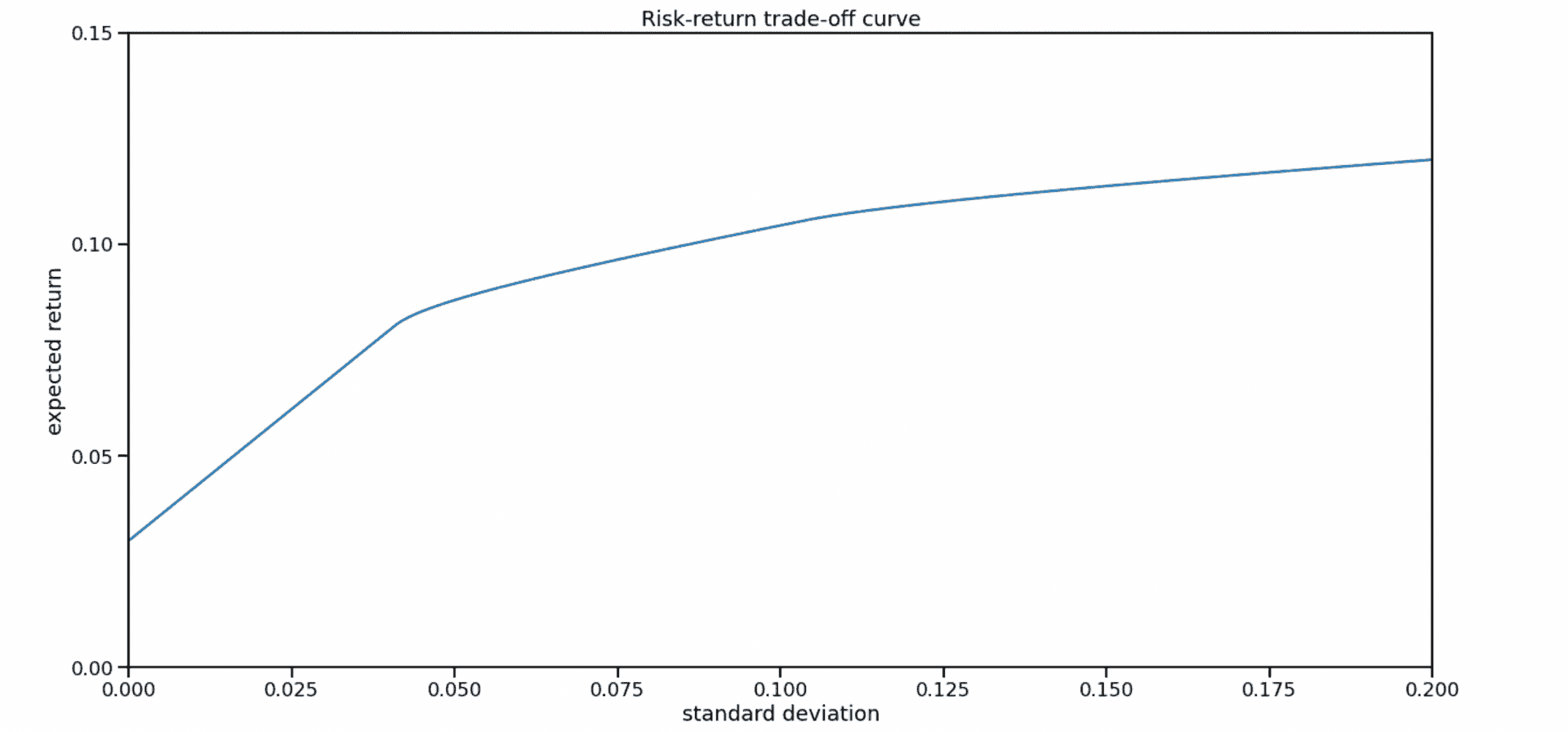

Risk-return tradeoff

I also tried to alter the return goal in order to get the risk-return curve and select the optimum of Sharpe ratio.

risks = []

returns = []

for expected_return in range(100000, 200000, 10000):

solution = solve_optimization(total_cost_constraint=100000, return_constraint=expected_return, norm_constraint=1000)

risks.append(math.sqrt(dot(solution['x'], matrix(covariance_matrix.to_numpy()) * solution['x'])))

returns.append(expected_returns)

# Plot trade-off curve and optimal allocations.

plt.figure(1, facecolor='w', figsize=(20,10))

plt.plot(risks, returns)

plt.xlabel('standard deviation')

plt.ylabel('expected return')

plt.axis([0, 30000, 150000, 200000])

plt.title('Risk-return trade-off curve')

plt.yticks([0.00, 100000, 150000, 200000])From the looks of the risk-return curve you can tell, that it does not make sense to aim for a yearly interest rate less than 10%, as variance for 0% portfolio and 10% portfolio is basically the same. This is reasonable, as we expect M2 money supply growth of 10% year-over-year, which means that even stagnating companies should be bringing 10% a year.

Currently, I am mostly investing in the Russian market, as it is undervalued and performs relatively well. However, I don’t like industrial companies in Russia, as historically they are managed by crooks, so my choice is limited to a handful of IT or finance companies with good reputation. When I decide that it is time to buy S&P 500 more heavily, I will rely on this approach more.

I don’t like the way I predict returns now, though. I will have to use better models. Their construction should allow for automation using data from APIs of parsed financial statements, and be different for stable and expanding companies. For instance, one could use the data from financialmodelingprep.com.

Capital Allocation Line, Capital Market Line and Sharpe ratio

Suppose that risk-free return in . Suppose that we want to create a portfolio, which consists of risk-free treasuries with return and risky market portfolio with expected return in a proportion to .

Expected return of this portfolio .

Variance of this portfolio .

Assuming risk-free income variance fixed and market and risk-free returns uncorrelated , we get:

, hence, .

Substitute this into expectation, resulting in:

.

Here we see an equation of a straight line, with an intercept and a slope . This quantity is known as Sharpe ratio.

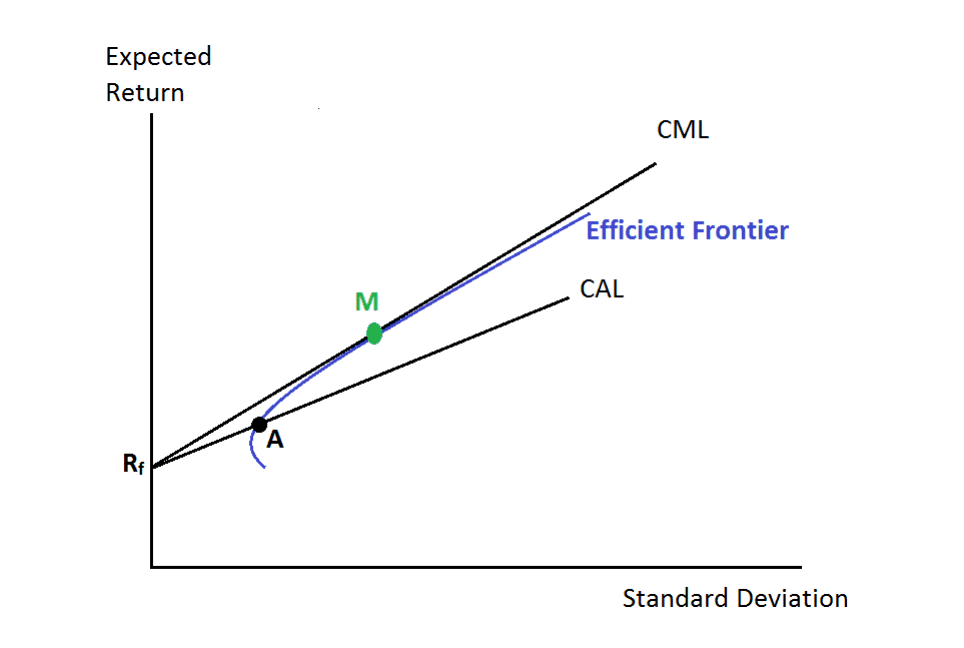

Let us look at a graphical illustration of this.

On this plot the abscissa is , not (counter-intuitively, I’d expect it to be market std , as we are seeking to maximize Sharpe ratio of a mix of bonds and stocks against a stock-only efficient frontier).

We are seeking to maximize the Sharpe ratio, return of mixed bonds+stocks portfolio to . It is achieved, when our Capital Allocation Line crosses the efficient frontier as high as possible (i.e. is tangent to it), resuling in Capital Market Line.

Also, we can choose some arbitrary point on the Capital Market Line. The further it is, the larger share of stocks is in our portfolio. Again, optimal share of stocks corresponds to the point, where CML touches the efficient frontier.

References

- https://www.kaggle.com/camnugent/sandp500 - S&P 500 dataset from Kaggle

- https://site.financialmodelingprep.com/developer/docs - financialmodelingprep API with financial data

- http://cvxopt.org/examples/tutorial/qp.html - cvxopt quadratic programming tutorial

- https://cvxopt.org/userguide/coneprog.html - cvxopt documentation details on quadratic programming, including the risk curve and L1 norm etc.

- https://cvxopt.org/userguide/index.html - cvxopt user guide

- https://www.stat.cmu.edu/~ryantibs/convexopt/lectures/dual-gen.pdf - primal-dual Lagrange problems by Ryan Tibshirani (no, it’s Robert’s son)

- https://www.investopedia.com/terms/r/riskreturntradeoff.asp - risk-return tradeoff

- https://medium.com/bearnbull/demystifying-the-magic-of-modern-portfolio-theory-5ed86a03e4dc - good intro to MPF from medium

- https://en.wikipedia.org/wiki/Markowitz_model - about Henry Markowitz

- https://www.di.ens.fr/~aspremon/PDF/INFORMS05sparsePCA.pdf - on Sparse PCA in finance

- https://scholarworks.calstate.edu/downloads/f1881p207 - masters thesis by Musaad A. Abalkhail, includes information on Capital Allocation Line and Capital Market Line

- https://analystprep.com/cfa-level-1-exam/portfolio-management/cal-cml/ - a nice derivation of expectation of portfolio return, CAL and CML

- https://en.wikipedia.org/wiki/Capital_allocation_line - Wikipedia on CAL

- https://en.wikipedia.org/wiki/Capital_market_line - Wikipedia on CML

Written by Boris Burkov who lives in Moscow, Russia, loves to take part in development of cutting-edge technologies, reflects on how the world works and admires the giants of the past. You can follow me in Telegram